Three solutions to the, “I can’t afford a house” problem.

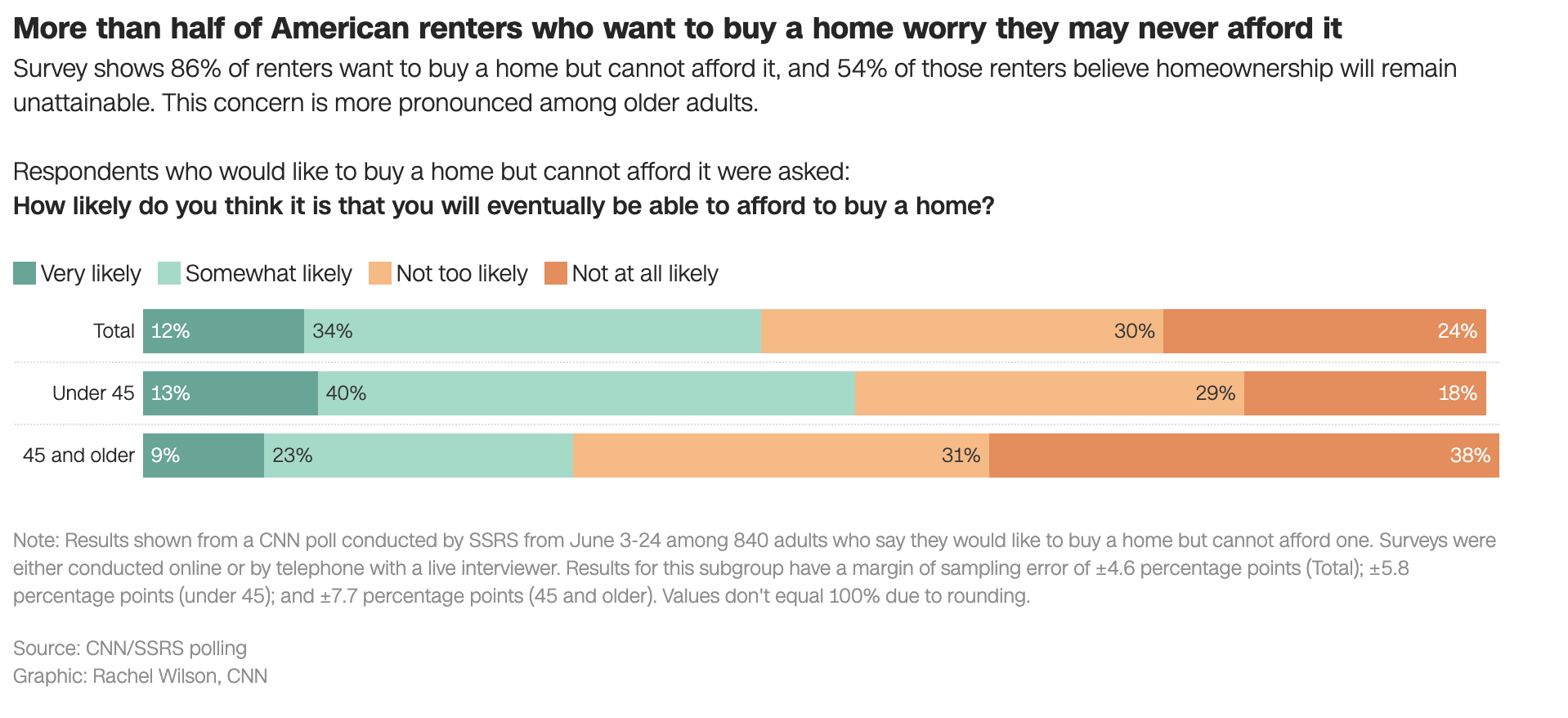

I lit a little bit of a fire last week via this email and on social media when I referenced this CNN article reporting that 47% of Americans under age 45 fear they’ll never afford a home.

I probably shouldn’t have posted about problems without offering some solutions. As the cool kids say, “That’s my bad.”

Here are potential solutions to the top three reasons people don’t believe they can buy a home.

Problem #1 - No Money for a Downpayment

Solution - Downpayment Assistance Programs

While I would never recommend someone buy a home with ZERO money saved up, there is a difference between having money saved up AND extra money saved up for a downpayment.

The good news for many buyers is that there are many downpayment assistance programs available, like this one that offers $25,000 to “first generation” home buyers - defined as buyers who

1) have never owned a home,

2) whose parents/guardians never owned a home, or

3) who lived in the foster care system.

More options are available here through the Colorado Housing and Finance Authority (CHFA).

There are also options to receive family gift funds or access retirement funds to assist. Email me if you’d like to learn more about your options.

Problem 2 - Monthly Payment is too Expensive

Solutions - Falling Interest Rates and House Hacking

Many buyers wish to own a home, but buying feels too expensive right now. After all, many people - perhaps you included - pay less in rent than they would in a monthly mortgage payment.

1) Interest rates are continuing to fall, resulting in buyers now who might lock in a 6.5% rate saving potentially HUNDREDS of dollars a month compared to buyers who previously bought at an 8% rate.

2) Refinances are easier than bidding wars. If rates continue to drop, you can have the opportunity to refinance (get a new loan) at that lower rate - which is way easier than shopping for a new home and potentially competing with all the other buyers.

What’s likely to happen when rates drop enough? Watch this short video.

3) Consider house hacking. House hacking is basically “having roommates” rebranded for Gen Z, but there are formal and informal ways to do it.

#1 Rent out bedrooms either to friends or through trusted roommate finding platforms and Facebook groups. These arrangements can be customized to your space and season of life.

#2 Rent out a furnished basement to short term AirBnB guests (under 30 days per guest). This requires a license and can either be self-managed or you can hire out the whole process to a management company.

#3 Offer mid-term rentals (guests over 30 days but less than a year) to professionals like travel nurses. These are all options for home buyers who can afford higher monthly but prefer not to pay it all themself.

Problem 3 - Desired Location is out of Your Budget

Solution - Alternative Neighborhoods

This one can be tough to stomach, but sometimes “I can’t afford a home” really means “I can’t afford a home WHERE I want to buy home.”

Sometimes the solution to this dilemma involves long distance relocation.

Other times, the solution is as simple as learning about new neighborhoods.

Part of every meeting I have with buyers is matching up their budget with neighborhoods.

For example, earlier this year I helped some buyers buy a home in a neighborhood with which they had been previously entirely unfamiliar.

Compromise is part of almost every home purchase. If you want to discuss your options, let’s connect.

If you have a desire to buy or sell, let’s chat.

Life has a way of keeping us all moving, and I’d love to be your real estate agent.

Contact me here to set up your free and confidential consultation.

Kevin